Discover Valuable Resources in our Content Hub

Whether you’re an industry expert or a curious learner, our diverse collection of resources awaits, offering valuable perspectives and empowering you on your journey to a healthier, more informed future.

Flyers

Select the dacadoo information you wish to receive. If you’re looking for something else, feel free to contact us.

White Papers & Reports

Select the dacadoo information you wish to receive. If you’re looking for something else, feel free to contact us.

An independent study on a Dutch insurer-led program (2015–2019) proves that dacadoo’s Digital Health Engagement Platform reduces healthcare costs by 4.9% in Year 1 and 5.3% in Year 2.

In recent years, there has been a significant increase in global privacy data regulations. While this benefits customers, it presents challenges for companies…..

Download our white paper, to find out how to get insurance unstuck, which are the new emerging customer expectations, the main innovations in and outside of insurance…

This report explores the findings from our Global Integrated Insurance Operator Survey, conducted in October 2020, through which we interviewed an audience of…

This white paper has been developed in conjunction with our Data Science team to bring to life the tangible outcomes our Health Scoring technology…

Infographics

Select the dacadoo information you wish to receive. If you’re looking for something else, feel free to contact us.

dacadoo’s Health Engagement Platform has demonstrated a 5% reduction in healthcare costs, as evidenced in an independent scientific study.

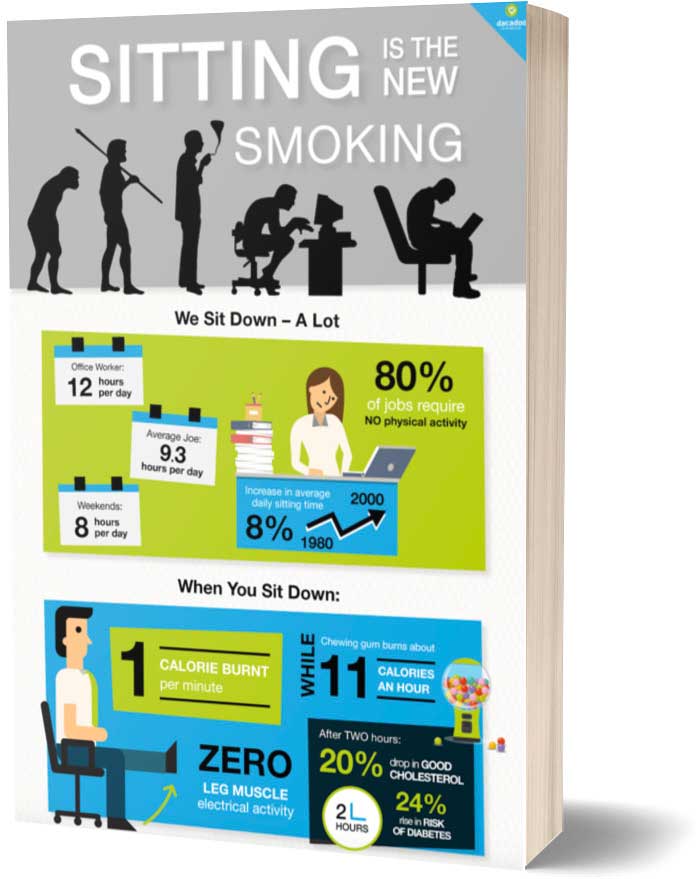

Sitting for long periods of time regularly, also known as sedentarism, affects a large part of the population globally.

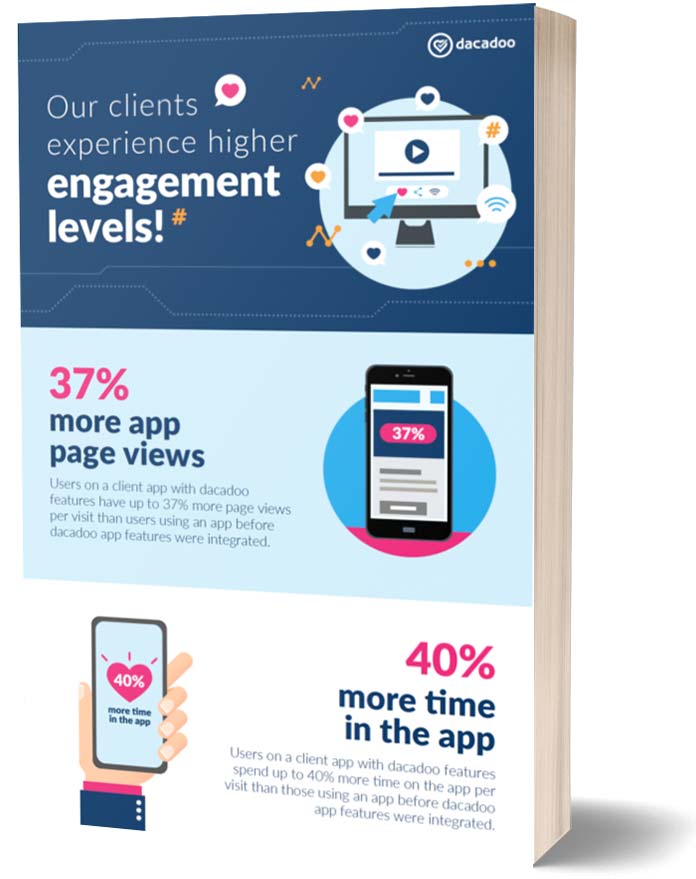

A brief overview of our documented results achieved during 2021 for both insurers and insureds.

Webinars

Select the dacadoo information you wish to receive. If you’re looking for something else, feel free to contact us.

Use Cases

Explore our Use Cases for great examples of how our clients have transformed with the use of our technology.

EFU Life Assurance

Innovating Health and Wellness with dacadoo’s Digital Health Engagement Platform

EFU Life Assurance, a leader in Pakistan’s life insurance sector, has always been at the forefront of innovation. With a commitment to improving the well-being of its customers, EFU Life recognized the growing need for integrating health & wellness into their offerings, leading to their partnership with dacadoo to offer a cutting-edge digital wellness platform. This proposition encourages users to integrate wellness into their daily lives, creating lasting personal impact that ultimately drives a wider cultural shift, positioning EFU as a key catalyst in Pakistan’s wellness movement.

bEHR Health Systems

How bEHR Health Powers Community Wellness and Health Equity with dacadoo

bEHR Health is a health tech company with a mission to serve the Black community through culturally aligned digital health…

Narayana One Health

The Narayana One Health Score enables you to know your inside story.

Launched exclusively for members of the Arya Health Plan, the Narayana One Health Score is part of our member benefits…

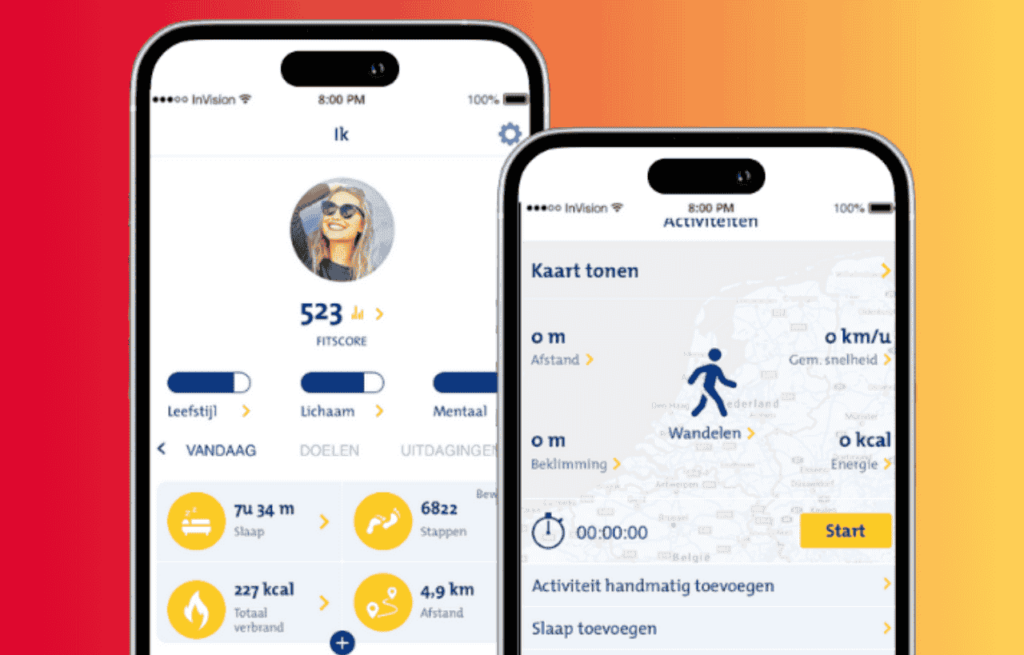

Dutch Insurer

Independent Study Shows dacadoo Platform Reduces Healthcare Costs

Collecting data from multigenerational participants between 2015 and 2019, the results from one particular study¹ on a program led by…

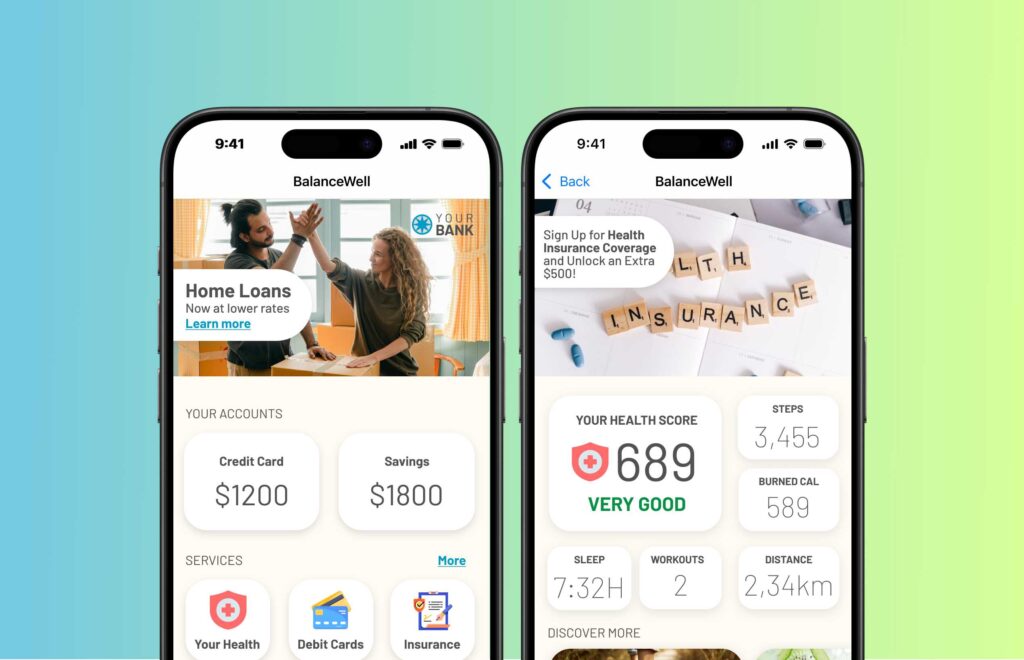

Global Bank

Leading Global Bank Boosts Cross-Selling with Innovative Gamified Wellbeing Program

A global bank added gamification and rewards to its mobile app, encouraging customers to reach health, mental, and financial goals….

Albertsons

Enhancing Customer Well-being: Albertsons’ Sincerely Health Delivers Tailored Pharmacy and Wellness Solutions

Albertsons, a prominent food and drug retailer in the United States, introduced Sincerely Health, a digital wellness platform aimed at…

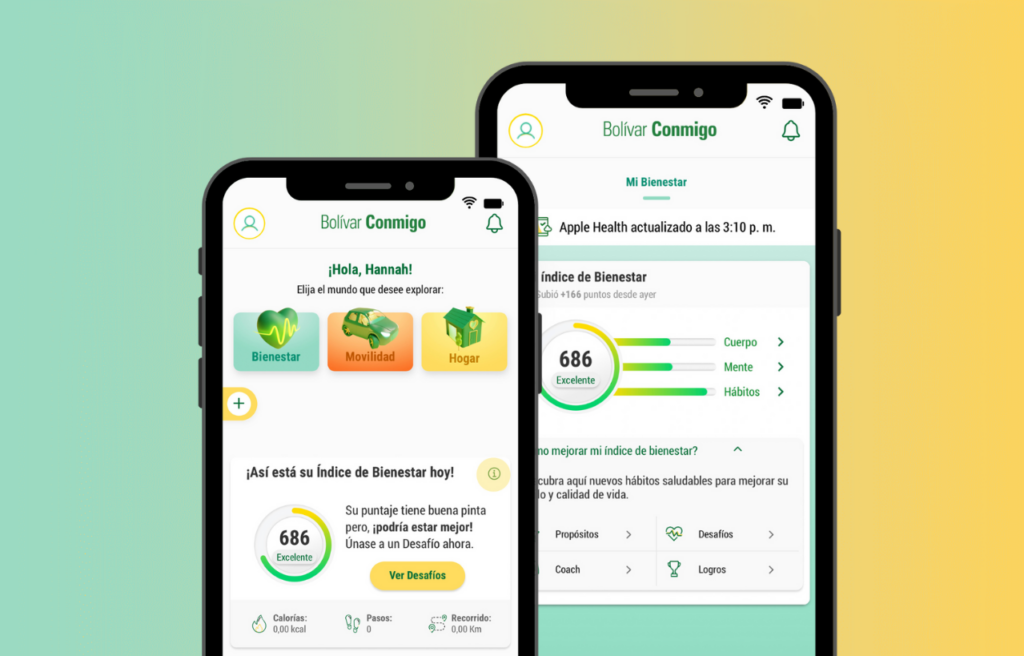

Seguros Bolivar

Seguros Bolivar’s Bolivar Conmigo Enhances Revenue Growth through Integrated Wellness Management

Bolivar Conmigo, by Seguros Bolivar, redefines insurance engagement with dacadoo’s API, integrating mobility and home services for holistic well-being management,…

bEHR Health Systems

How bEHR Health Powers Community Wellness and Health Equity with dacadoo

bEHR Health is a health tech company with a mission to serve the Black community through culturally aligned digital health…

Seguros Bolivar

Seguros Bolivar’s Bolivar Conmigo Enhances Revenue Growth through Integrated Wellness Management

Bolivar Conmigo, by Seguros Bolivar, redefines insurance engagement with dacadoo’s API, integrating mobility and home services for holistic well-being management,…

EFU Life Assurance

Innovating Health and Wellness with dacadoo’s Digital Health Engagement Platform

EFU Life Assurance, a leader in Pakistan’s life insurance sector, has always been at the forefront of innovation. With a…

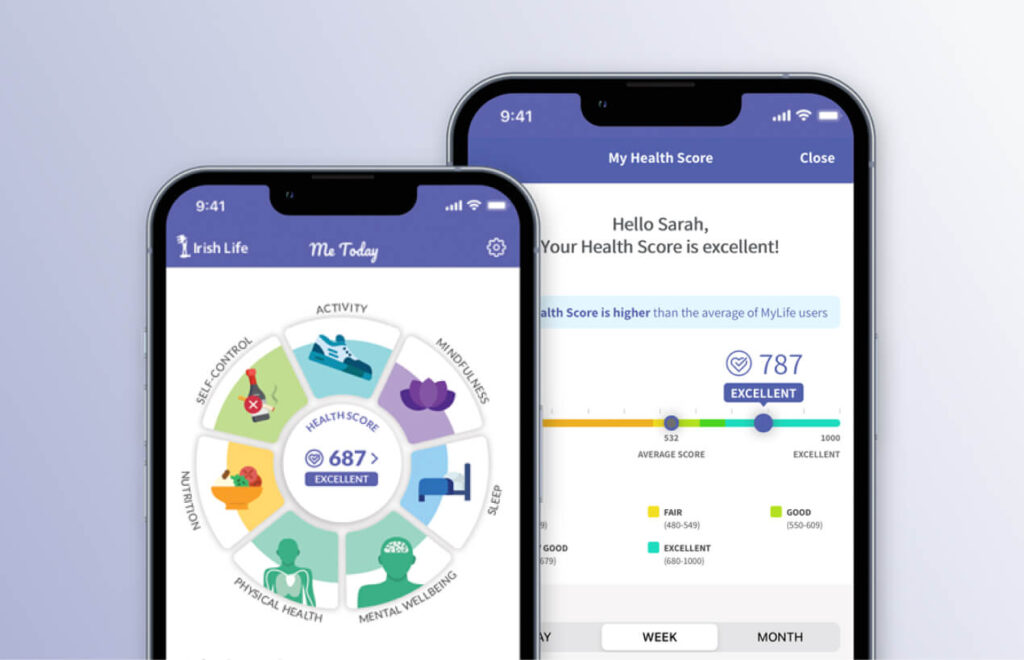

Irish Life

MyLife by Irish Life is the first app of it’s kind in the Irish Market.

MyLife is a one stop shop in helping people live healthier lives. Launched in May 2019, we’ve been on a…

Our Certifications