BLOG

Latest Articles

Explore the latest health and wellbeing news and insights

• 5 minutes read

As operational costs rise in the health and life insurance industry, insurers must adopt smarter strategies to stay competitive. This article explores 7 ways to…

-

By Masako Boskovski

• 5 minutes read

As operational costs rise in the health and life insurance industry, insurers must adopt smarter strategies to stay competitive. This article explores 7 ways to…

-

By Masako Boskovski

2025 marks the full arrival of Health 4.0, where the measure of progress has shifted from lifespan to healthspan. Between the two lies prevention, the new frontier where technology bridges those worlds, shaping health as a journey built uniquely for each of us. The reflections below share what digital health platform provider dacadoo has learned during the last 15 years of building that bridge — lessons that continue to define the age of personalised prevention.

-

By Manuel Heuer

Celebrating 15 years of dacadoo — from a bold idea on a ski slope to becoming a global leader in digital health engagement. Discover key milestones, lessons learned, and what’s next for predictive and preventive health as dacadoo continues shaping the future of health engagement and innovation.

-

By Masako Boskovski

As insurance shifts toward a data-driven model, technology is redefining risk assessment and customer engagement. By leveraging AI, predictive analytics, and wellness app data, insurers can optimize underwriting, reduce claims costs, and offer personalized policies. This transformation enhances efficiency, improves customer experience, and paves the way for a more proactive and cost-effective insurance industry.

-

By Masako Boskovski

The healthcare industry is unlocking savings through data monetization. With dacadoo’s health wellness tracking app, organisations can harness real-time insights to optimise costs, improve efficiency, and enhance decision-making. Turning health data into actionable savings drives smarter resource allocation and better patient outcomes. Discover how this approach transforms healthcare economics.

-

By Masako Boskovski

While most people are aware that excess weight is a major financial burden on the healthcare system, people tend not to appreciate the scale of the problem. Research from the McKinsey Health Institute (MHI) projects a $2.67 trillion loss in GDP by 2050, due to the impact obesity has on labor force participation and productivity.

Within the wider economy, the rising tide of chronic conditions linked to high Body Mass Index (BMI) is a serious economic challenge for insurers, healthcare providers, and self-insured employers that’s driving up healthcare spending and eroding profitability.

Fortunately, a growing body of evidence (perhaps a poor choice of expression) confirms that even modest weight loss is directly associated with a significant, measurable cost reduction in healthcare. The question is no longer ‘if’ weight loss saves money, but how to achieve it—and more importantly, how to sustain it as a behavioral change at scale. In this article, we’ll explore the relationship between BMI and healthcare costs, and how dacadoo’s Digital Health Engagement Platform (DHEP) bridges the gap between clinical evidence and measurable financial action.

-

By Masako Boskovski

Faced with rising costs, growing mental health needs, workforce shortages, and a widening gap between our lifespan and health span, current healthcare models are struggling, to say the least. While there’s no doubt that changes are needed in healthcare, the question is what form these changes will take.

Emerging as a solution frontrunner is digital health engagement. The sustained use of technology to manage health and wellness is a data-backed strategy that shifts the center of gravity from reactive, expensive care to proactive, cost-saving prevention.

In this article, we’ll examine the considerable advantages that digital health engagement brings to the healthcare equation, and how platforms like dacadoo’s Digital Health Engagement Platform (DHEP) may be the answer that insurers and healthcare providers are looking for.

-

By Masako Boskovski

Digital banking has made services faster and more accessible, but it has also reduced personal connections. With branch visits nearly gone, customer engagement in banking is harder to sustain—yet it’s engagement that builds trust and drives loyalty. A new engagement model is needed, one that connects financial well-being with health & wellness. Guided by the principle that health is wealth, banks can adopt digital wellness strategies to strengthen relationships and deliver long-term value. This article explores how applying wellness principles through a Digital Health Engagement Platform (DHEP) offers banks a modern way to drive loyalty and stay competitive.

-

By Masako Boskovski

It wasn’t that long ago that health-conscious shopping was a niche pursuit that ran second place to the simple satisfaction of eating. In the past few decades, however, that’s all changed. More than just a fleeting trend, health-conscious shopping is a cultural phenomenon that’s reshaped consumer expectations—and the entire retail landscape along with it.

With food now commonly recognized for its impact on well-being—and, indeed, as a form of medicine—retailers are at the frontline of daily grocery health decisions. In this article, we’ll examine why the “Food as Medicine” perspective is so important for modern retailers, and how platforms like dacadoo can help improve customer loyalty, brand differentiation, and long-term growth.

-

By Masako Boskovski

In Part 1 of our series, we explored how the Grocery Basket Score (GBS™) deepens customer engagement and builds loyalty by providing clear, personalized nutrition guidance. GBS™ is a science-based score that evaluates the overall nutritional quality of a customer’s shopping basket over time. In this second part, we’ll see how GBS™ is much more than just a customer engagement tool—it’s a powerful engine for direct commercial growth that drives tangible increases in revenue.

-

By Masako Boskovski

Whether your consumers love grocery shopping or find it a chore, one thing’s for sure: the overwhelming array of products and product data available can make healthy shopping an arduous task. But what if retailers could make the process easier by offering personalized, science-backed guidance?

This idea is at the core of Grocery Basket Score (GBS™). A pioneering, nutrition-first tool, GBS™ is a science-based system that automatically scores the nutritional quality of a shopper’s monthly purchases, delivering clear, actionable insights without any effort needed from the customer. In this first part of a 2-part blog series, we’re going to look at how GBS™ allows retailers to become trusted partners in their customers’ health, driving engagement and customer loyalty in the process.

-

By Masako Boskovski

If there’s one sector that’s under continual pressure to deliver more results using fewer resources, it’s healthcare. With chronic diseases and mental health needs on an upward trajectory, health care providers are facing an increasingly uncomfortable reality; traditional reactive approaches to care are unsustainable.

A solution to this considerable challenge does exist, however, in the form of patient engagement. This is the active involvement of individuals in managing their own health. A powerful, yet largely neglected factor in the care equation, patient engagement has the potential to deliver scalable medical prevention and vastly improved outcomes for everyone involved. In this article, we’ll examine what modern patent engagement means, the benefits it offers, and how digital health platforms like dacadoo are helping to turn this potential into a reality.

-

By Masako Boskovski

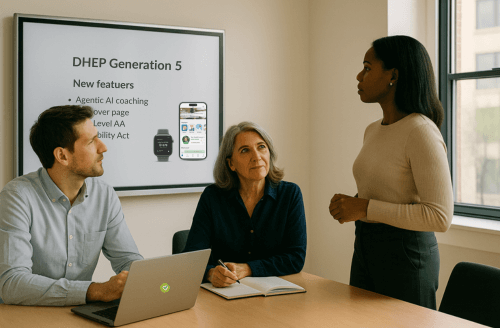

There’s been no slowing down at dacadoo, we have been working hard over the past months to deliver an amazing new refresh to our platform. As the seasons shift and energy rises around the world, we are right on time to provide our users with extra motivation to prioritize their health and wellbeing, no matter where they are.

In this article we will be breaking down some of these incredible improvements and how we’ve designed these solutions.

-

By Beatriz Dias

Bancassurance, once primarily a sales-led distribution channel, is undergoing a major digital transformation. 2025 has seen it evolve into a data-driven, customer-centric process that’s shifting its focus from mere product distribution to broader health engagement and personalized wellness. This change is reshaping how financial institutions and insurers collaborate, moving them toward a future where insurance is far more smoothly integrated into everyday financial decisions. In this article, we’ll examine the trends driving this change, the rise of embedded insurance, and how platforms like dacadoo are accelerating the process.

-

By Masako Boskovski

Retail loyalty is evolving. Consumers expect more than discounts; they want daily value, purpose, and connection. Discover how dacadoo’s Generation 5 platform empowers retailers to build wellness-based loyalty that lasts beyond the transaction.

-

By Fernando Doblas

As operational costs rise in the health and life insurance industry, insurers must adopt smarter strategies to stay competitive. This article explores 7 ways to reduce costs, from AI-driven claims automation to predictive underwriting, wellness apps, and fraud prevention. Learn how digital transformation and data-driven strategies can enhance efficiency and cut expenses.

-

By Masako Boskovski

As insurance shifts toward a data-driven model, technology is redefining risk assessment and customer engagement. By leveraging AI, predictive analytics, and wellness app data, insurers can optimize underwriting, reduce claims costs, and offer personalized policies. This transformation enhances efficiency, improves customer experience, and paves the way for a more proactive and cost-effective insurance industry.

-

By Masako Boskovski

The healthcare industry is unlocking savings through data monetization. With dacadoo’s health wellness tracking app, organisations can harness real-time insights to optimise costs, improve efficiency, and enhance decision-making. Turning health data into actionable savings drives smarter resource allocation and better patient outcomes. Discover how this approach transforms healthcare economics.

-

By Masako Boskovski

The healthcare landscape is evolving, pushing patient engagement beyond traditional models. Patients now demand active participation, convenience, and personalization. Leveraging digital tools and data, with empathy, fosters lasting engagement. Discover how these insights create a more proactive, personalized experience.

-

By Masako Boskovski

The digital health revolution is reshaping how organizations across industries engage with users, shifting from reactive care to proactive wellness management. This guide explores top 10 essential digital health tools, highlighting their potential and practical applications to drive meaningful connections and improve health outcomes.

-

By Masako Boskovski

Customer retention in life and health insurance relies on personalized experiences, efficient claims, and wellness programs to address evolving customer needs. By using digital tools and predictive analytics, insurers can improve engagement, reduce churn, and build long-term loyalty.

-

By Masako Boskovski

To boost customer engagement, retailers should focus on personalized experiences, leverage technology, and create exclusive, memorable interactions. Learn from other brands, and discover how to integrate health and wellness data for deeper connections and loyalty.

-

By Masako Boskovski

In today’s fast-paced retail environment, acquiring new customers is critical to stay competitive. However, focusing solely on acquisition spend isn’t enough, efficiency is key. This guide outlines seven customer acquisition strategies that balance growth and profitability.

-

By Masako Boskovski

This guide explores 10 proven strategies to improve retention in retail that go beyond traditional methods, including omnichannel retailing, exclusive offers, and value-added services like free shipping or health-focused programs.

-

By Masako Boskovski

In the highly competitive banking industry, customer retention is more than just a strategy—it’s a necessity. Retaining customers is not only more cost-effective than acquiring new ones, but it also significantly boosts profitability. This article delves into effective strategies for enhancing customer loyalty, from personalized services and digital transformation to community involvement.

-

By Masako Boskovski