Among the biggest threats to global economies and healthcare systems are Non-Communicable Diseases (NCDs). They are responsible for over 70% of deaths worldwide (WEF). The World Economic Forum is now appealing for a focus on total health and well-being, encouraging a holistic health approach that encompasses mental and physical well-being, along with socio-economic determinants of health.

Studies suggest that investment in primary preventive care reduces unnecessary specialist referrals, hospitalizations and emergency room visits, and results in better health outcomes for patients. Research by Portland State University in Oregon shows that for every $1 invested in primary care, $13 is saved in downstream costs. Many factors impact the prevalence of NCDs, with lifestyle factors accounting for around 40% of the total impact.

At dacadoo, we focus on the preventive aspect of NCDs; continually improving our health engagement and risk quantification products, enhancing our technology, and striving to work towards a better, safer, and healthier future for everybody.

Life Insurance Solutions

Digital Health Engagement Platforms

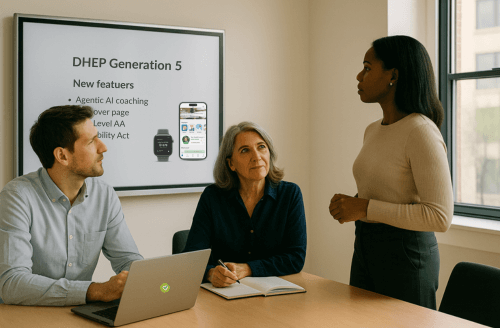

dacadoo’s Digital Health Engagement Platform (DHEP) stands at the crossroads between consumers aspiring to lead healthier lives and insurers aspiring to know their policyholders better in order to provide them with the relevant care or services they may need.

Our DHEP is a health and wellness technology platform that’s offered as-a-service and includes a web and mobile software application, data warehouse and analytics model. At the heart of the DHEP is our award-winning Health Score technology, which represents an individual’s holistic health with a single number between 0 and 1,000.

Using health and wellness data from our DHEP, insurers can help policyholders improve their Health Score through AI driven coaching, gamification, and other relevant and meaningful engagement tactics throughout the policyholder’s life.

Through the dacadoo platform a person is engaged on a continual basis to ensure health improvement is an active goal. By the person becoming healthier, or staying healthy, the reduction in potential medical treatment and claims are direct benefits.

The dacadoo Risk Engine

Our Risk Engine is driving the future of underwriting. It enables insurers and reinsurers to issue policies with confidence and speed, reducing the need for physical assessments.

The dacadoo Risk Engine is based on more than 300 million person years of data from scientific research. It processes more than 80 data points, grouped into four categories: biometrics, diagnosed diseases, family history and modifiable lifestyle behaviors.

With as few as four data points – height, weight, age, sex at birth – the Risk Engine produces full estimation sets with 60+ values for each person. That’s because it uses imputed values – or conditional expectations – for what’s missing.

The Risk Engine produces results of 89.4% ROC AUC in under a second. The estimated values include the risk of a person dying from several diseases (mortalities) and getting sick from several diseases (morbidities), as well as missing data values. Therefore, the Risk Engine helps insurers reduce the need for paramedical exams and time-consuming, costly evidence gathering.

Life Insurance Partners

Hiring over half a million employees worldwide, Accenture is one of the best-known professional services company. A Fortune 500 company, it serves clients in over 120 countries across the globe and we are pleased to have them as one of our strategic partners for Life Insurance services.

By providing our Risk Engine and Digital Health Engagement Platform to their clients, Accenture has reinforced their insurance offering. Their DHEP proposition is available both as a standalone product or pre-integrated with the Accenture Life Insurance & Annuity Platform (ALIP). Similarly, our Risk Engine can be integrated seamlessly with ALIP automation to add even greater underwriting speed and utility, or it can be accessible standalone through a simple RESTful API.

The American multinational computer technology corporation Oracle has partnered with dacadoo to offer our DHEP to Life & Health Insurance operators. Oracle realized its huge capacity to improve global healthcare and wellness and were immediately onboard by integrating dacadoo with their OIPA and OHI solutions.

In a recent Oracle blog, they talked about our DHEP’s key benefits: “The insured have better health, a longer lifespan and in some cases additional health-plan benefits, depending on the reward system introduced by the health insurer or payor. For the health insurers or payors, they can reduce the cost of claims, be more profitable and provide better health plans for the insured.”

To learn more about our digital Life & Health Insurance offering please contact us or request a demo.