要点

- 今日の保険会社は、データを活用して従来の「事後対応型」モデルから「予防型」モデルへと転換を図っています。これにより、リスク評価の精度が向上し、予防的な介入も可能となります。

- データ主導型のデジタルヘルス・エンゲージメント・プラットフォームは、医療費の削減効果が実証されており、1年目には4.9%、2年目には5.3%の削減を達成すると同時に、顧客との関係強化にも寄与しています。

- 先進的な保険会社は、AIとリアルタイムデータを活用して業務を変革しており、たとえば請求処理の迅速化といった明確な成果を上げています。

データ主導の保険戦略と導入事例

保険業界は、かねてよりデータ集約型の産業でした。アクチュアリー表(生命表)から請求履歴に至るまで、保険商品はデータを基盤として設計・価格設定されています。 しかし今日では、利用可能なデータの量と種類、そしてデータ分析ツールの進化によって、保険業界における可能性は大きく変化しています。保険会社は、リスク評価、顧客との関係構築、サービス提供の方法を改善するために、データを活用する強力な手段を次々と発見しています。これにより、よりパーソナライズされた顧客体験を提供し、業務を効率化し、データドリブンなインサイトに基づくまったく新しいビジネスモデルを構築しています。

本記事では、今日の保険会社が実際に成果を上げている5つのデータ戦略を、実例を交えてご紹介します。

なぜ保険業界においてデータ主導の顧客インサイトが重要なのか

現代の保険会社は、データを収益化して新たな収益源を創出する一方で、従来の大まかな属性情報ではなく、個々の行動データに基づいて商品をパーソナライズしています。 請求処理も、従来の数日から数週間かかっていたものが、わずか数秒で完了するようになっています。 リスクの特定もかつてないほど高い精度で可能となり、年に一度の契約更新ではなく、継続的なエンゲージメントを通じて、顧客とのより深い関係を築いています。

最も大きな変革は、「事後対応型」から「予防・先回り型」の保険モデルへの転換です。従来のように、事故や病気が発生した後に保険金を支払うだけでなく、先進的な保険会社は現在、データを以下の2つの革新的な方法で活用しています。 1つは、リスクをより正確に理解・評価し、それに応じた保険料を算出すること。もう1つは、事故や損害が発生する前に顧客と連携して予防策を講じることです。 この根本的な変化により、保険会社の役割は単なる「経済的保障の提供者」から、「リスク評価の専門家」そして「予防のパートナー」へと広がりを見せています。

では、保険会社は実際にどのようにデータを活用して、これらの成果を実現しているのでしょうか?

5. 保険業界を変革するデータ主導型戦略

1. デジタルヘルスエンゲージメントプラットフォーム

医療保険および生命保険会社は、健康促進活動への継続的な参加を促すデジタルプラットフォームを導入するケースが増えています。これらのプラットフォームは、健康データのトラッキング、個別ガイダンス、ソーシャル機能、インセンティブを組み合わせることで、顧客と保険会社双方にメリットのあるポジティブな行動変容を促進します。

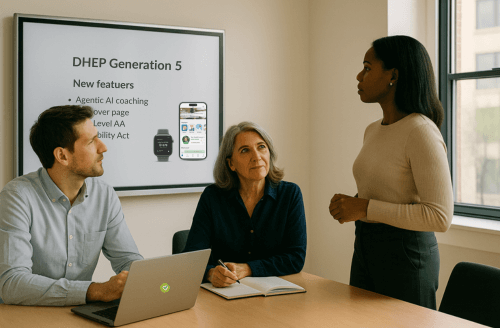

dacadooは、このアプローチを体現する2つの補完的なツールを提供しています。 当社のデータ主導型デジタルヘルス・エンゲージメント・プラットフォーム(DHEP)は、ユーザーが身体活動を記録し、個人の健康目標を設定し、チャレンジに参加し、パーソナライズされたコーチングを受けることを可能にします。

リスク評価においては、当社のリスクエンジンが、限られた自己申告の健康・ライフスタイルデータを継続的なリスクインサイトへと変換します。このエンジンは、年齢・性別・体重・身長のわずか4つのデータポイントからでも死亡率および罹患率の確率を算出可能であり、最大100種類以上の指標を取り込むこともできます。 この科学的アプローチにより、相対的な死亡確率の推定において91.6%の精度(ROC-AUC)を実現しています。

ビジネス価値は、リスク評価の精度向上と顧客維持の強化という両面から生まれます。契約者は健康データを共有することで具体的なメリットを得られるため、エンゲージメントが高まり、結果として保険会社の継続率や収益性も向上します。

導入事例

- 医療保険:ウェルネスプラットフォームは、健康活動や予防医療をゲーミフィケーション化することで、抽象的な健康目標を具体的かつ達成可能な行動へと変換します。これらのプラットフォームには通常、チャレンジ要素、報酬、そしてソーシャル機能が組み込まれており、健康的な行動をより楽しく魅力的なものにします。

- 生命保険: ウェアラブルデバイスと連携したアプリは、健康的な行動に対して保険料の割引やその他のインセンティブを提供します。定期的な運動、適切な睡眠、その他の健康増進行動を促進することで、こうしたプログラムは保険会社と被保険者の双方にメリットをもたらします。

2.リアルタイムのデータ収集と分析

リアルタイムのデータ収集は、保険会社のリスクの理解と管理のあり方を大きく変革します。従来のように定期的にデータを取得するモデルとは異なり、リアルタイムの収集ではリスクの変化を即座に把握することができ、迅速かつ的確な対応が可能となります。

この戦略により、保険会社は従来の人口統計的な前提ではなく、実際の行動に基づいて保険料を動的に調整できるようになります。 International Journal of Future Mathematics and Researchに掲載された研究によると、リアルタイムのデータ分析を導入した結果、リスク評価の精度が31.8%向上し、引受処理時間が67.5%短縮されたと報告されています。

導入事例

- 自動車保険: テレマティクス機器やスマートフォンアプリによって運転行動を継続的にモニタリングすることで、実際の運転パターンに基づいて保険料が調整される使用ベース保険(UBI:Usage-Based Insurance)モデルが可能になります。

- 損害保険:住宅や商業施設に設置されたIoTセンサーは、損害請求に至る前の異常や危険な兆候を検知することができます。

- 健康保険 dacadooのようなツールは継続的な健康モニタリングを可能にし、保険会社がリスクの兆候を早期に把握し、予防的な介入を促すことで医療費の削減につなげることができます。

3.保険金請求業務における予測分析の活用

予測分析は、保険金請求処理を従来の事後対応型・手作業中心のプロセスから、先回り型・データ主導の業務へと変革します。これらの技術は、膨大な過去データおよびリアルタイムデータを分析することで、請求プロセス全体の効率性、正確性、そして顧客体験を大幅に向上させます。

機械学習アルゴリズムは、請求金額の重篤度を予測し、不正の兆候を特定し、リソース配分を最適化することができます。さらに、従来の方法よりも迅速かつ一貫性のある保険金請求処理を実現します。

導入事例

- 自動車保険 AIモデルは、事故写真、車両データ、請求内容を分析し、修理費用を見積もるとともに、請求を適切なルートへと振り分けます。これにより、正当な請求は迅速に処理され、不正の可能性があるケースは調査対象としてフラグ付けされます。

- 健康保険: dacadooのような健康エンゲージメントアプリは、合併症や再入院につながるパターンを認識することができ、保険会社が医療提供者と連携して予防的な介入を行うことを可能にします。

4.AI(人工知能)と自然言語処理(NLP)

人工知能(AI)、特に自然言語処理(NLP)は、保険業界全体における複雑な情報処理タスクを担っています。これらの技術により、これまで多大な人的リソースを必要としていた文書分析、顧客対応、意思決定プロセスの自動化が実現されています。

アクセンチュアの調査によると、AIおよび機械学習ベースのデータ分析の活用において、自社が「先進的」と回答した請求関連の幹部は半数未満でした。一方で、80%が「これらの技術がさらなる価値をもたらす」と考えており、65%は「今後3年間で1,000万ドル以上をAIに投資する計画がある」と回答しています。

導入事例

- 商業保険: 自然言語処理(NLP)システムは、長文の保険契約書や企業からの申請書類から重要な情報を抽出します。この技術は、複雑な契約書、業界特有の用語、法規制の要件などを読み取り、解釈することができ、人間の引受査定者では不可能なスピードで処理を行います。

- 健康保険: AIは医療記録を分析し、矛盾点を特定したり、補償内容の判断を最適化したりします。こうしたシステムは、何千ページにも及ぶ医療履歴を数日ではなくわずか数秒で確認し、問題点や補償のギャップを即座に検出することが可能です。

5.データ活用による顧客ごとの最適なカスタマージャーニー

データに基づくパーソナライゼーションは、個々のニーズや嗜好、リスクプロファイルに応じた保険体験を実現します。保険会社は、顧客とのさまざまな接点から得られるデータを分析することで、的確なコミュニケーションを行い、最適な補償内容を提案し、あらゆる場面で個別化されたサービスを提供することが可能になります。

この戦略により、従来の画一的な保険提供モデルは、顧客一人ひとりに合わせた高度にカスタマイズされた関係へと進化します。その結果、エンゲージメント、満足度、そしてロイヤルティの向上が期待できます。

導入事例

- 生命保険:システムは、結婚、出産、住宅購入といった重要なライフイベントを認識し、それに応じた適切な補償の提案を自動的に行うことができます。顧客の同意を得たうえでデータをモニタリングすることで、保険のニーズが変化するタイミングを逃さず、保険会社は最適なタイミングでアプローチできます。

- 自動車保険ドライバーフィードバックアプリは、実際の運転パターンに基づいたパーソナライズされたアドバイスを提供します。これらのアプリは、急ブレーキや急加速といった具体的な運転行動を検出し、安全性向上のための的確なコーチングを行います。

- 健康保険: コミュニケーションは、個々の健康リテラシーのレベルや好まれるチャネルに合わせて最適化されます。一般的な健康情報ではなく、顧客一人ひとりの健康状態や過去のやり取りに基づいた、関連性の高いパーソナライズされたコンテンツが提供されます。

データ主導型保険のケーススタディ

デジタルヘルスアプリで医療費削減

オランダの医療保険会社が、利用者の健康状態の把握と改善を支援するウェルネス・アプリを発表した。その効果を調査したところ、デジタル健康エンゲージメント・プラットフォームが医療費と利用率に大きな影響を与えることが実証された。この研究では、15,506人の参加者のデータを分析し、デジタルヘルスプラットフォームの導入により、初年度の医療費が4.9%削減され、2年目には5.3%に増加することがわかった。これは、1年目には1人当たり約133ドル、2年目には152ドルの節約になる。

プラットフォーム利用においては、使用の強度よりも「頻度」がより重要であることが判明しました。つまり、断続的に集中的に使うよりも、継続的かつ定期的に利用する方が、医療費の削減効果は大きいのです。 この結果は、デジタルヘルスプラットフォームが健康成果を改善すると同時に、定量的なビジネス効果ももたらすことを示しています。保険会社にとっては、「コスト削減」と「顧客エンゲージメント」という二重のメリットが得られる点で、これらのプラットフォームは非常に価値の高いデータ・イノベーションと言えるでしょう。

Progressive社:テレマティクスデータでリスク評価を高度化し、保険コストを削減

Progressive社のSnapshotプログラムは、テレマティクスデータを活用した使用ベース保険(UBI)の中でも、業界で最も成功している取り組みのひとつです。 Progressiveは、従来の保険料算出要素だけでなく、実際の運転行動に基づいて自動車保険料をパーソナライズしています。このデータは、スマートフォンアプリまたは車両に接続する専用デバイスを通じて収集され、急ブレーキ、急加速、運転時間帯、運転中のスマホ使用、走行距離などの要素を検出します。

Progressive社によると、Snapshotプログラムを通じて、これまでに累計12億ドル以上の割引が提供されています。 このプログラムを利用して保険料を節約したドライバーは、プログラム終了後、年間平均231ドルの節約を実現しています。

Progressive社のデータ主導型アプローチは、複数のビジネス上のメリットをもたらしています。 より正確なリスク評価、アプリを通じた定期的な顧客との接点によるエンゲージメントの向上、そして最終的には請求件数の削減につながる、安全運転への行動変容を促す力を備えています。

Lemonade社:AIによる保険金請求処理コストの削減

Lemonade社は、クレームボットAI Jimを導入することで、保険金請求処理に革新をもたらしました。このAIは、全請求の約3分の1を人間の介入なしに自動処理しています。

Lemonade社の報告によると、AI Jimは2021年に全請求の30%以上を自律的に処理し、平均処理時間はわずか3秒でした。 このスピードと効率は、AI Jimが持つ高度な能力、すなわち、請求データの分析、補償範囲の判断、自然言語処理(NLP)と機械学習アルゴリズムを活用した正確な支払い判断によって実現されています。

即時の保険金支払いを実現する同社の能力は、従来は長期化しがちだった保険業界において、非常に強力な差別化要因となっています。

保険業務の未来を切り拓く、データ主導の変革

データ主導のイノベーションは、リスク評価、請求処理、顧客エンゲージメントにおける明確な改善を通じて、保険業務を変革します。 保険会社は、戦略的なデータ活用によって業務効率を大幅に向上させると同時に、顧客体験の質も高めることができます。

業務変革に向けてデータ・イノベーションを活用したいとお考えの保険会社様に向けて、dacadooは、効率性の向上と契約者の成果改善を両立させる包括的なソリューションを提供しています。 進化し続ける保険業界の中で競争優位性を築くために、データ主導の革新をどのように活かせるか、ぜひデモをご予約ください。